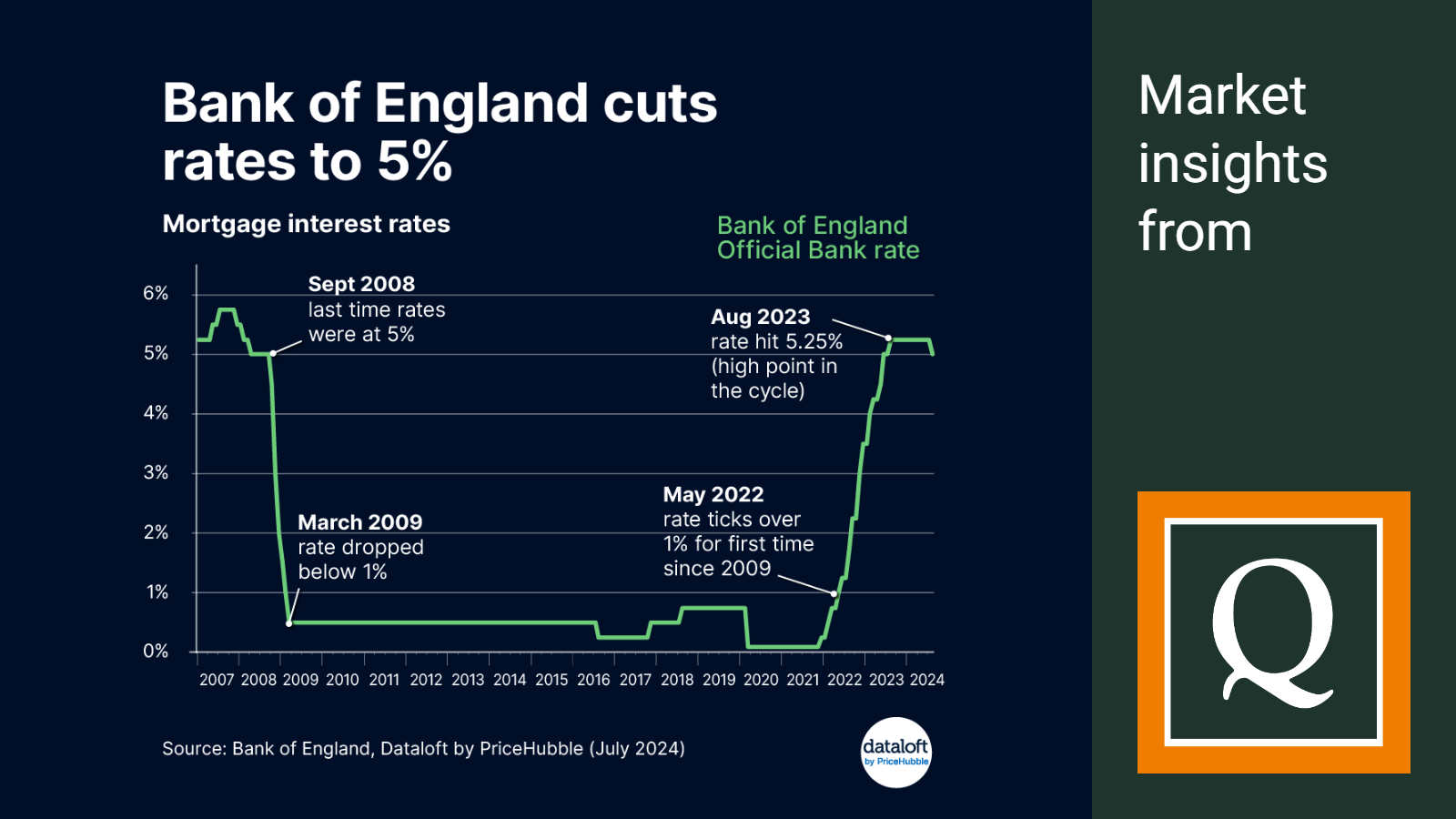

The long-awaited cut in the Bank of England base rate finally materialised in early August, signalling the Bank's confidence that inflationary pressures are slowly coming under control.

This first cut since 2020 reduces the rate by a quarter of a percentage point and will be welcome news to homeowners with variable mortgage rates – or those considering a home move.

The Monetary Policy Committee voted by 5 votes to 4 to cut rates and the Governor made clear that he wants to proceed with caution saying 'we need to make sure inflation stays low and be careful not to cut 'too quickly or by too much'.

Commentators now expect one or possibly two more cuts before the end of 2024. This will also be a welcome boost for housebuilders who rely on borrowing to finance new developments – and their role is critical if the government is to meet its ambitious 1.5m housebuilding target.

Get some of the best and latest mortgage deals for your property

Our Financial Services team at Quealy & Co are ready to help first-time buyers, current homeowners, and property investors. Get in touch with our friendly team to find out how we can help you get the best deal.

01795 505761

**Your home may be repossessed if you do not keep up repayments on your mortgage.**

Quealy & Co Financial Services Ltd. is authorised and regulated by the Financial Conduct Authority No. 919693

Source: Bank of England, Dataloft by PriceHubble. July 2024

Other Stories

28 March 2025

Design An Easter Egg Competition!

17 March 2025

Your March 2025 Property Market Update

09 March 2025

by

by