The Faversham property market continues to capture attention as a key destination for buyers, renters, and investors. With an average property price of £330,798 as of Q4 2024 and a current supply of 350 properties, equating to approximately 9.35 months of availability, the town provides a range of opportunities for those looking to invest or settle. Whether you're seeking a family home, an investment property, or rental accommodation, Faversham’s market offers something for everyone.

As we step into 2025, this article explores the dynamics of the Faversham property market, providing relevant insights for the coming months and beyond.

Faversham’s Sales Market: Options for Every Buyer

Faversham’s property market is notable for its diversity, with homes catering to first-time buyers, families, and high-end buyers alike. Properties are spread across various price points and configurations, ensuring wide appeal.

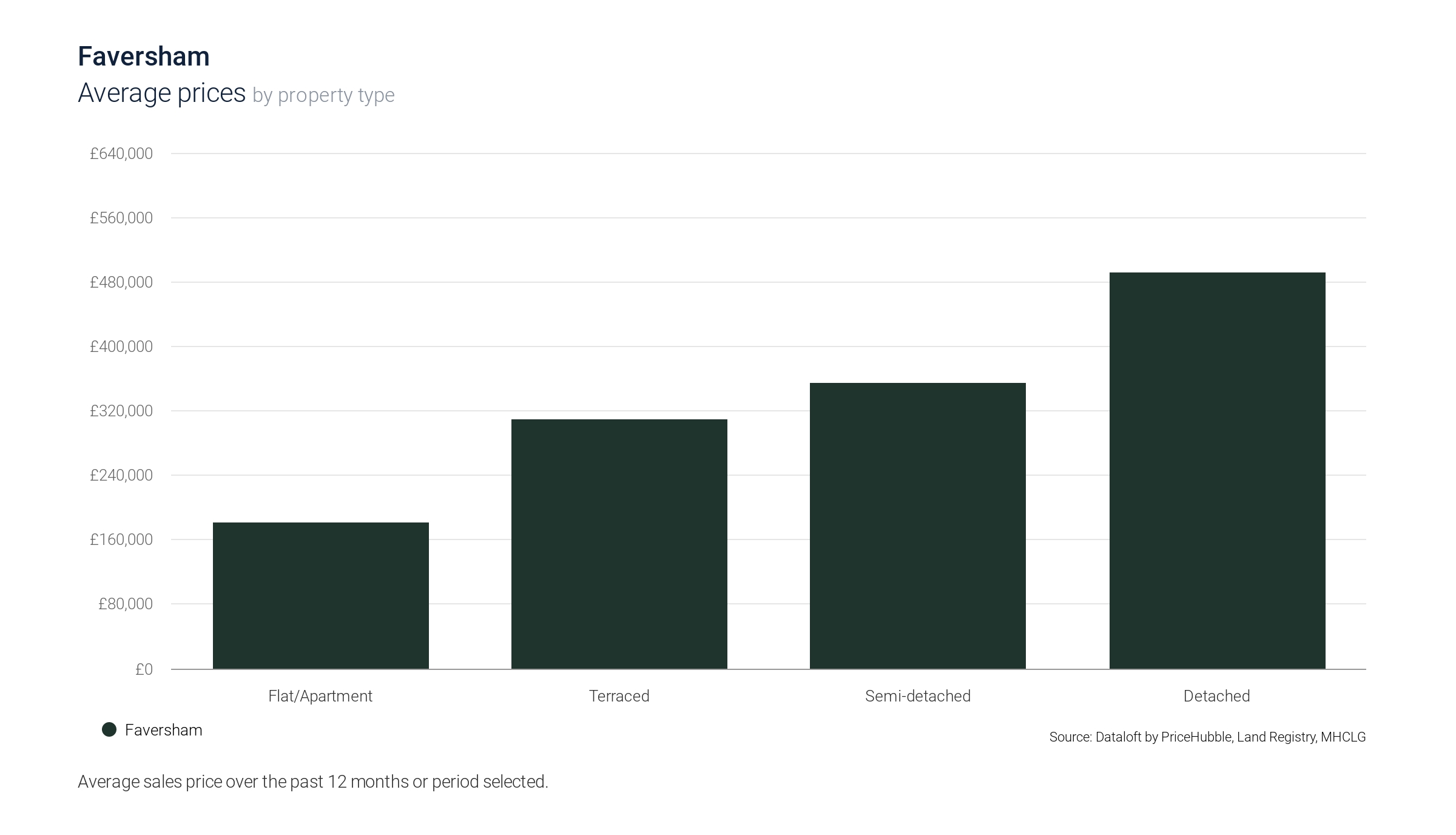

Detached Homes

Detached houses remain the most sought-after properties in Faversham, with an average price of £492,385. These homes typically offer spacious layouts, private gardens, and premium features, making them popular among growing families and professionals looking for high-quality living. For buyers seeking long-term family residences or substantial investment properties, detached homes in Faversham present solid opportunities.

Semi-Detached Properties

Semi-detached homes, averaging £355,202, offer a balance of space and affordability. These properties particularly appeal to families who value comfort and value for money. They also hold strong potential for capital appreciation, especially in established residential neighbourhoods.

Terraced Houses

Terraced houses are a key segment of the market, with an average price of £309,091. Combining period charm with affordability, they attract a mix of first-time buyers and investors. Many of these homes are situated in prime locations close to the town centre, offering convenience and character that remains in demand.

Flats and Apartments

With an average price of £182,201, flats and apartments provide an accessible entry point to the property market. These are particularly attractive to young professionals, downsizers, and investors looking to maximise rental yields. Modern apartments near the station or town centre tend to command higher demand due to their commuter-friendly locations.

Rental Market Trends: Strong Demand and Growth

Faversham’s rental market remains robust, offering steady returns for landlords and varied options for tenants. Over the past year, the average monthly rent has increased by 5%, reaching £1,155. This growth is fueled by demand from young professionals, a shortage of rental stock, and the town’s appeal as a commuter-friendly hub.

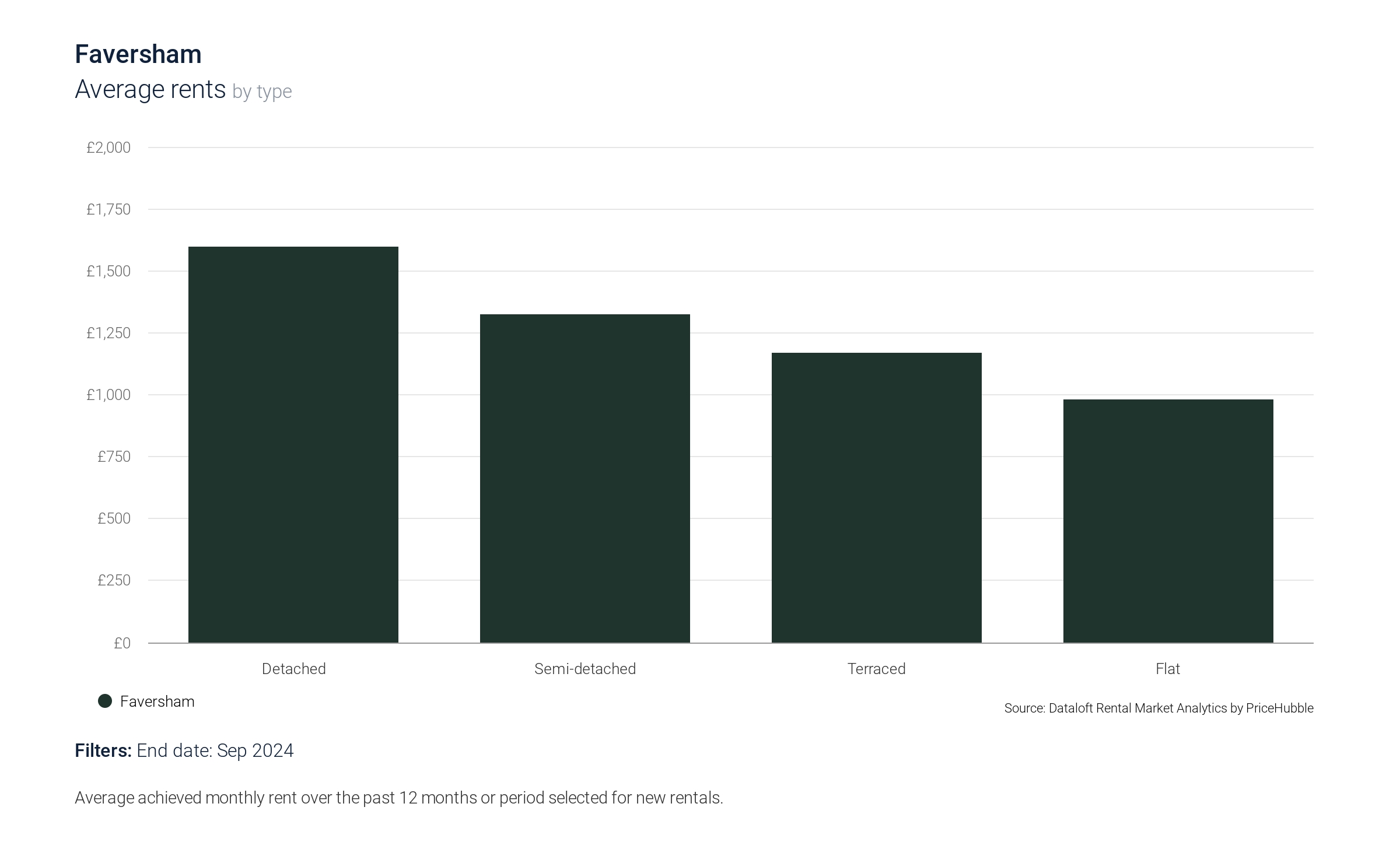

Rental Prices by Property Type

- Detached Homes: £1,596/month on average, catering to tenants seeking premium living spaces.

- Semi-Detached Homes: £1,326/month, appealing to families seeking a balance of space and value.

- Terraced Houses: £1,172/month, providing affordability for tenants and solid yields for landlords.

- Flats and Apartments: £983/month, representing the most accessible rental option and delivering strong yields.

Rental Demand by Property Size

Flats makeup 39% of lettings in Faversham, driven by demand from young professionals and commuters. On the other hand, houses cater to families seeking larger living spaces, achieving higher rents on average. Notably:

- Studio flats average £783/month.

- One-bedroom flats rent for £902/month, and two-bedroom flats achieve £1,065/month, reflecting strong demand for compact, affordable living spaces.

- Larger three-bedroom flats command £1,256/month, highlighting a growing appetite for more spacious apartments.

Houses demonstrate even greater rental potential, with:

- One-bedroom houses averaging £1,026/month, appealing to young couples or individuals seeking a standalone living.

- Two-bedroom houses achieving £1,126/month are often preferred by small families.

- Three-bedroom houses renting for £1,315/month, aligning with family needs.

- Four-bedroom houses commanding £1,576/month, ideal for larger households or executive tenants.

This segmentation underscores the versatility of Faversham’s rental market, making it an attractive option for tenants and landlords alike.

Investment Insights: Opportunities Across Price Ranges

The Faversham property market offers well-defined segments catering to a variety of investor profiles. Whether you are a first-time buyer, a seasoned landlord, or a high-net-worth investor, there are opportunities across all price brackets.

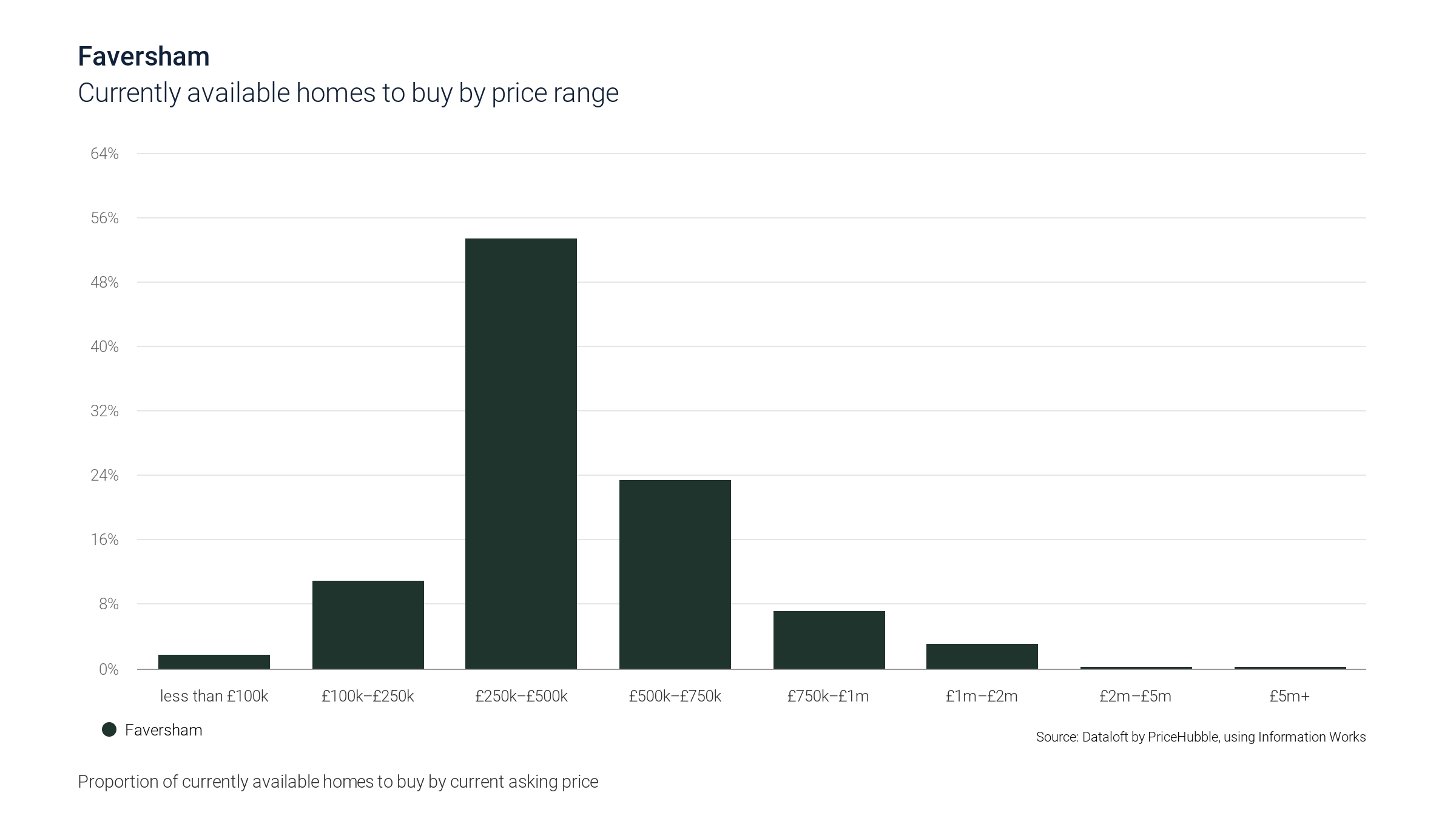

Entry-Level Properties

Homes priced under £250,000 make up 12.57% of the market and are particularly appealing for first-time investors. These properties often deliver strong rental yields due to high demand from young professionals and first-time renters. Flats in this price range are especially popular, offering an affordable route into Faversham’s competitive market.

Mid-Market Properties

The mid-market, comprising 53.43% of available properties, is the cornerstone of Faversham’s housing landscape. Homes in the £250,000–£500,000 range are favoured by families and long-term investors seeking stability and appreciation potential. These properties often enjoy steady demand and represent the fastest-moving segment in the market.

Premium and Luxury Homes

High-end properties priced between £500,000 and £750,000 (23.43%) cater to a growing demographic of professionals and families seeking larger, well-appointed homes. These homes are located in desirable areas like Abbey Street or The Mall, offering unique features like period architecture and premium finishes.

At the top end, properties above £750,000 (10.28%) serve a niche market of high-income buyers and investors targeting premium rental opportunities. Executive tenants often seek these properties for their space, privacy, and distinctive charm.

Key Market Dynamics and Trends

Several factors are shaping the Faversham property market as we approach 2025, creating opportunities and considerations for buyers, renters, and investors.

Time on Market

The average time on the market for properties in Faversham is currently 49 days, a 68% increase from the previous year. This longer timeframe provides potential buyers with greater flexibility to negotiate, especially in higher price brackets. However, mid-market properties near the station or town centre often sell or let much faster due to strong demand.

Stable Pricing

Faversham’s average property price has shown stability in recent months, rising slightly to £330,798 in September 2024. This steady trend reflects the market’s resilience and appeal, even as wider economic conditions remain uncertain. Buyers and investors can expect moderate appreciation over the long term, particularly in areas close to key amenities and transport links.

Rental Market Growth

The rental market’s 5% year-on-year growth signals strong fundamentals, driven by increasing demand and limited stock. Flats, particularly near the station or town centre, continue to attract renters quickly, offering landlords reliable returns.

Why Faversham? Long-Term Appeal

Faversham’s property market is supported by several enduring strengths, ensuring its appeal for buyers, renters, and investors over the long term:

- Historical Charm: Faversham’s blend of period properties and modern developments makes it attractive to a wide audience.

- Commuter Convenience: Strong transport links to London and Europe via the high-speed rail network make it a preferred location for professionals.

- Diverse Housing Options: The market caters to a variety of needs, from affordable starter homes to luxury family residences.

- Community and Lifestyle: Faversham’s vibrant community, rich history, and access to nature enhance its livability, drawing interest from families and professionals alike.

Strategic Considerations for 2025

For those considering the Faversham market, the following factors are worth keeping in mind:

- Negotiation Opportunities: With a longer average time on the market, buyers may find increased opportunities for price negotiations, particularly in higher price brackets.

- Strong Rental Yields: Investors should focus on mid-market properties near the town centre or station, which consistently achieve 5-6% rental yields.

- Capital Growth Potential: Period properties in conservation areas like Abbey Street or The Mall are likely to see strong appreciation due to limited supply and high demand.

- Target Tenant Demographics: With 20% of renters aged 25–29, properties tailored to young professionals—such as one- or two-bedroom flats—are in particularly high demand.

Faversham Property Market Outlook

Faversham’s property market is well-positioned to maintain its appeal in the coming year. With stable pricing, strong rental demand, and diverse housing options, the town continues to offer opportunities for buyers, investors, and renters alike.

Whether you’re seeking a family home, a long-term investment, or properties to rent in Faversham, the market offers a balanced mix of value and potential. As we move into 2025, Faversham’s enduring strengths—its historical charm, modern amenities, and strategic location—are set to sustain its growth and attractiveness for the foreseeable future.

Faversham offers a compelling combination of opportunity and lifestyle for property investors seeking long-term capital growth or renters looking for a well-connected and family-friendly community. The town’s robust property market and diverse housing options make it an attractive choice for a range of needs.

At Quealy & Co Faversham estate agents, we specialise in helping customers navigate the Faversham property market, offering expert advice on buying, selling, letting, and property management. Our experienced team understands the local market and is dedicated to maximising the potential of your investment.

Contact us today to arrange a consultation or request a free property valuation. Let us help you achieve your property goals with confidence and expertise.

Other Stories

21 April 2025

Your April 2025 Property Market Update

17 April 2025