As we approach the end of 2024, Rainham's property market continues to demonstrate remarkable resilience. Using comprehensive data from Dataloft through August 2024, combined with our on-the-ground expertise, we bring you the most relevant insights for buyers, sellers, and investors in this thriving Medway Towns community.

Current Market Dynamics

Our most recent Dataloft data shows Rainham maintaining a healthy market balance with 350 available properties - representing 6.24 months of supply. This sweet spot between oversupply and scarcity has continued through autumn, creating opportunities for both buyers and sellers as we head into winter.

Price Trends & Property Mix: A Market Snapshot

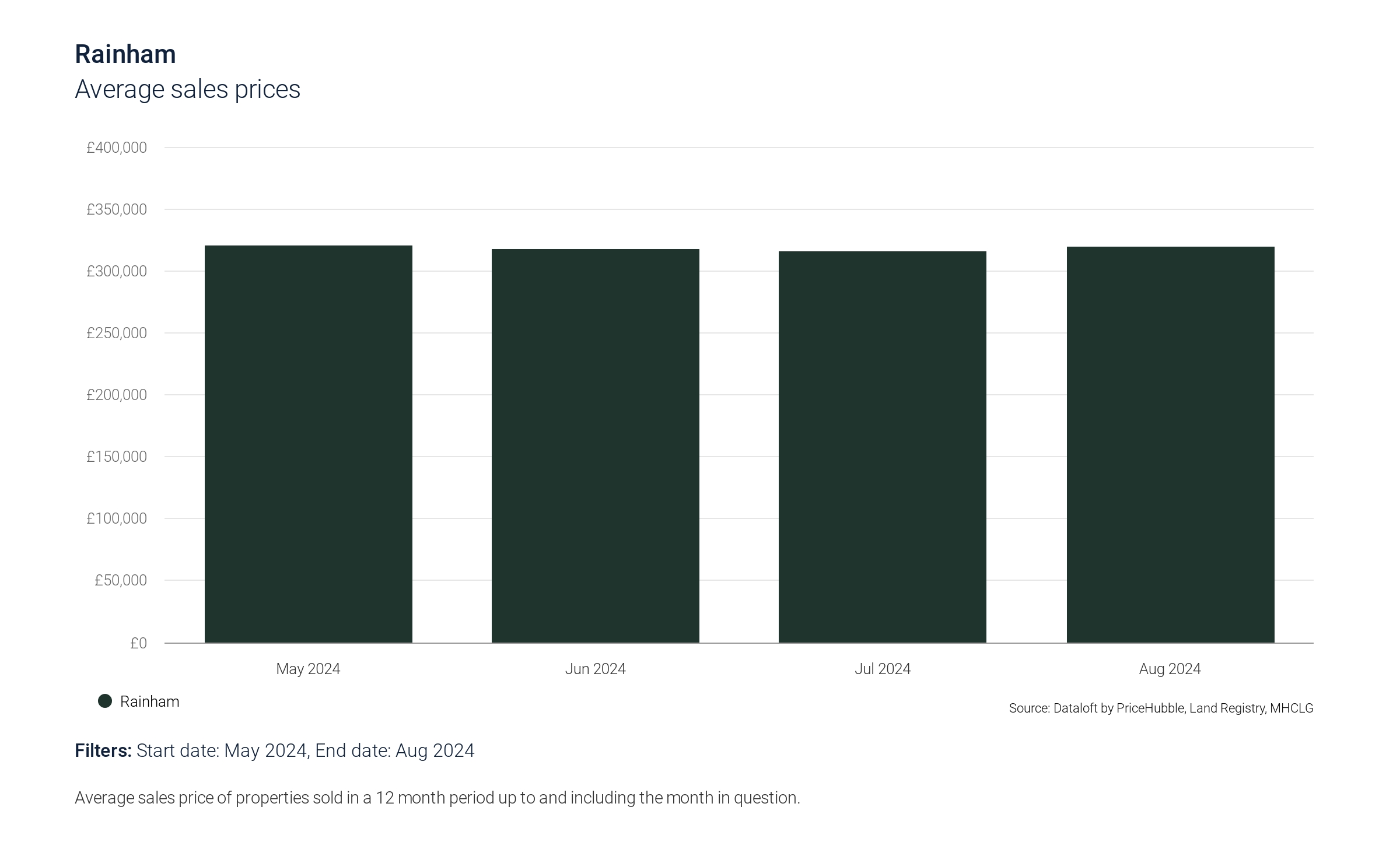

The property market has shown remarkable stability as we enter Q4 2024, with average prices holding steady at £319,194. This equilibrium offers fascinating insights into our current market segmentation.

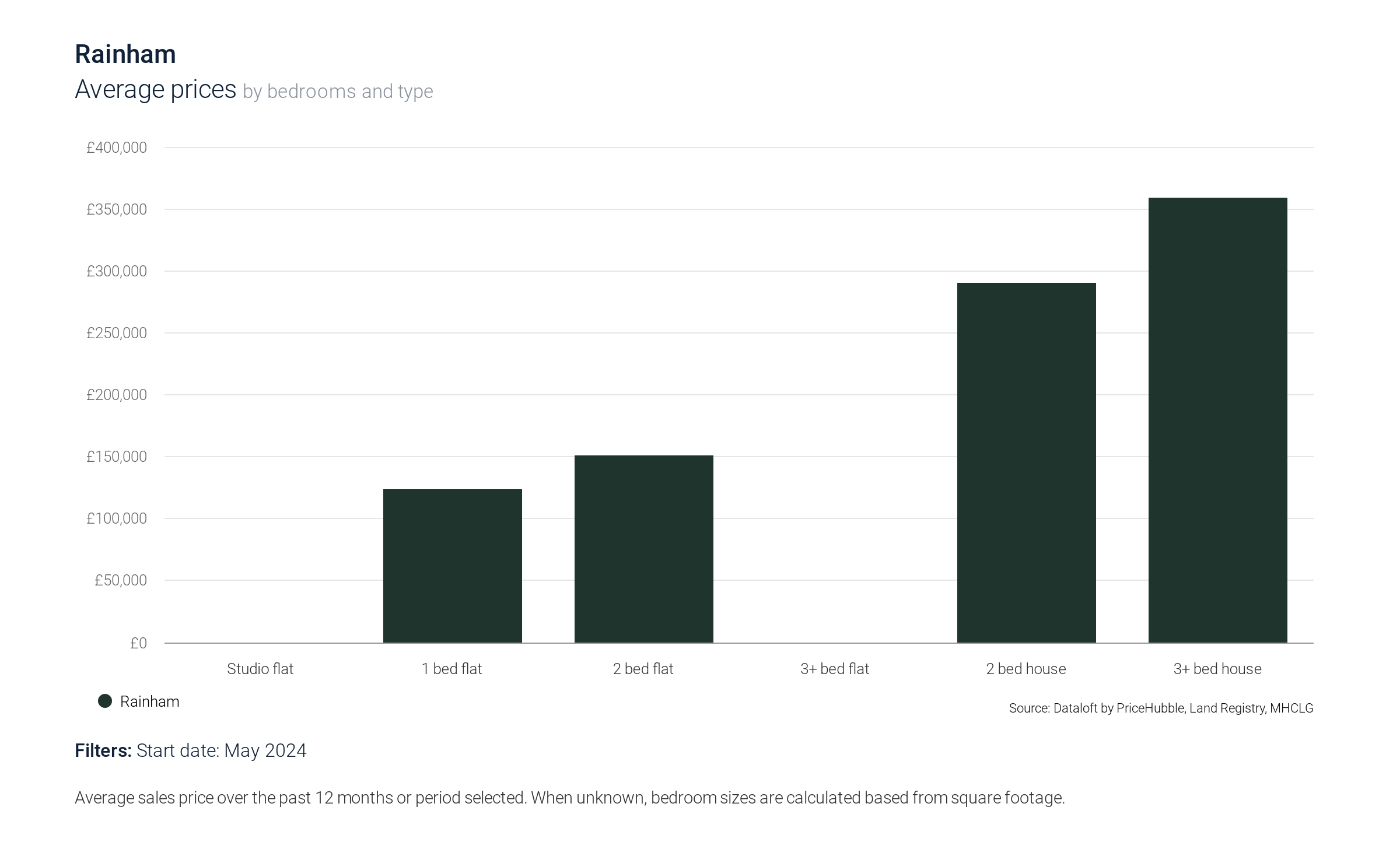

Looking at the property ladder, detached homes continue to command premium prices at £511,851, while semi-detached properties settle at £337,320. The mid-market sees terraced houses at £301,831, with flats providing an accessible entry point at £131,360.

What's particularly interesting is the bedroom configuration pricing structure. First-time buyers can still find one-bed flats from £124,175, while two-bed flats hover around £151,195. The jump to houses is significant, with two-bed houses at £290,330 and three+ bedroom homes averaging £359,094.

This price stratification reveals a healthy market ecosystem, with clear stepping stones for buyers at different life stages. The substantial price gaps between property types suggest continued strong demand for family homes, while the more modest flat prices maintain vital market accessibility for new buyers.

Rental Market Momentum: Growth Through 2024

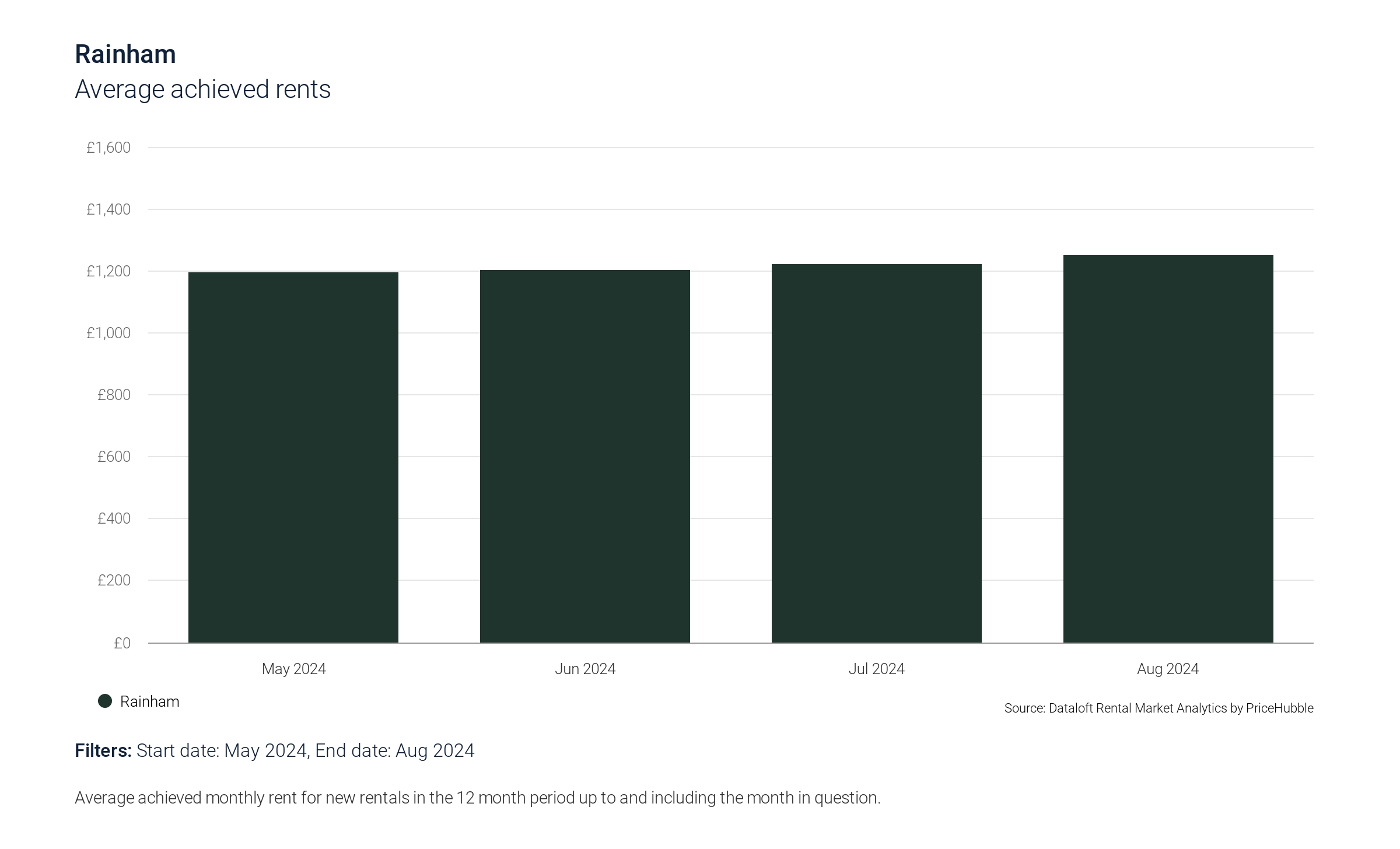

Rainham's rental market emerges as a standout performer in 2024's property landscape, demonstrating robust growth and resilient demand. Latest data reveals an impressive 11% year-on-year surge in rental values, pushing the average monthly rent to £1,263 (Dataloft, 2024).

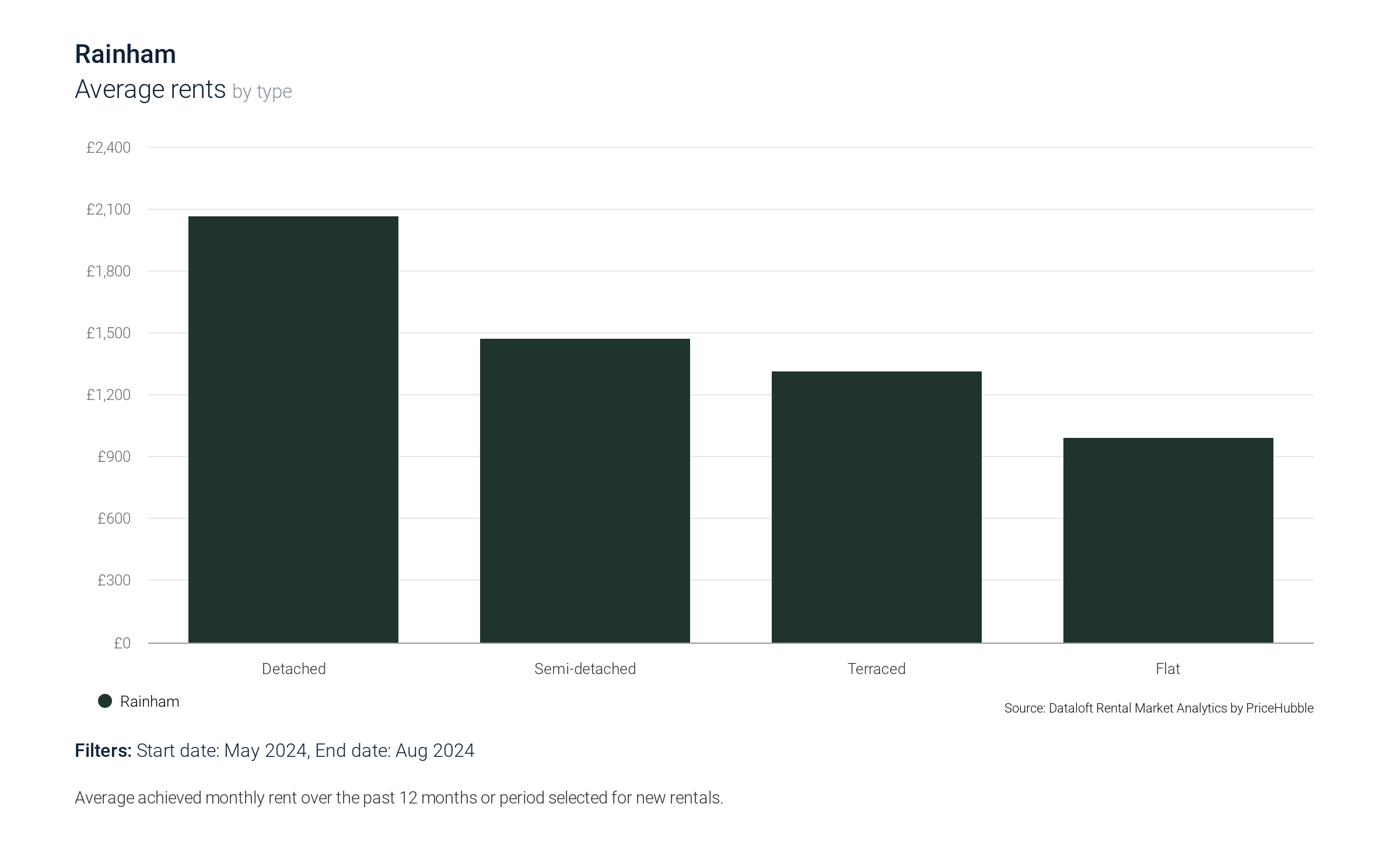

The market shows clear segmentation across property types. At the premium end, detached properties command £2,062 monthly, reflecting high demand for spacious family homes. Semi-detached properties maintain strong appeal at £1,473, while terraced houses offer a sweet spot at £1,314. Flats continue to provide accessible entry points at £989, making them particularly attractive to young professionals and first-time renters.

This sustained upward trajectory in rental values, particularly through the autumn months, positions Rainham as an increasingly appealing prospect for property investors. The substantial price differentials between property types suggest a well-balanced market catering to diverse tenant needs, from single professionals to growing families.

[Source: Dataloft, 2024]

Infrastructure & Investment: A Strategic Analysis

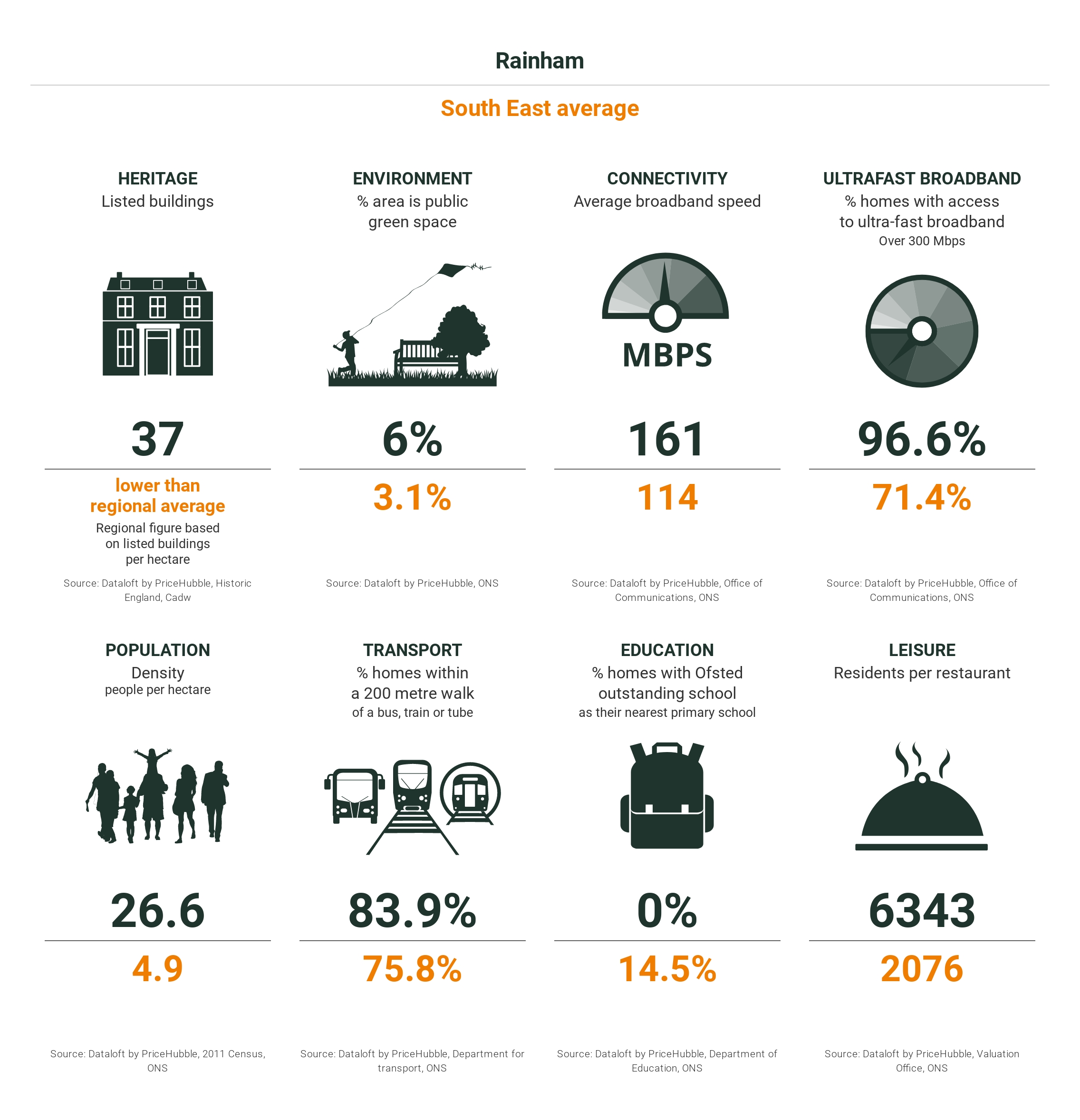

Rainham presents a compelling investment case, blending robust digital connectivity and strategic accessibility. With 96.6% of homes enjoying ultra-fast broadband (161 MBPS average) and 83.9% of properties within 200m of public transport, the area caters exceptionally well to remote workers and London commuters. The thoughtful allocation of 6% green space further enhances residential appeal.

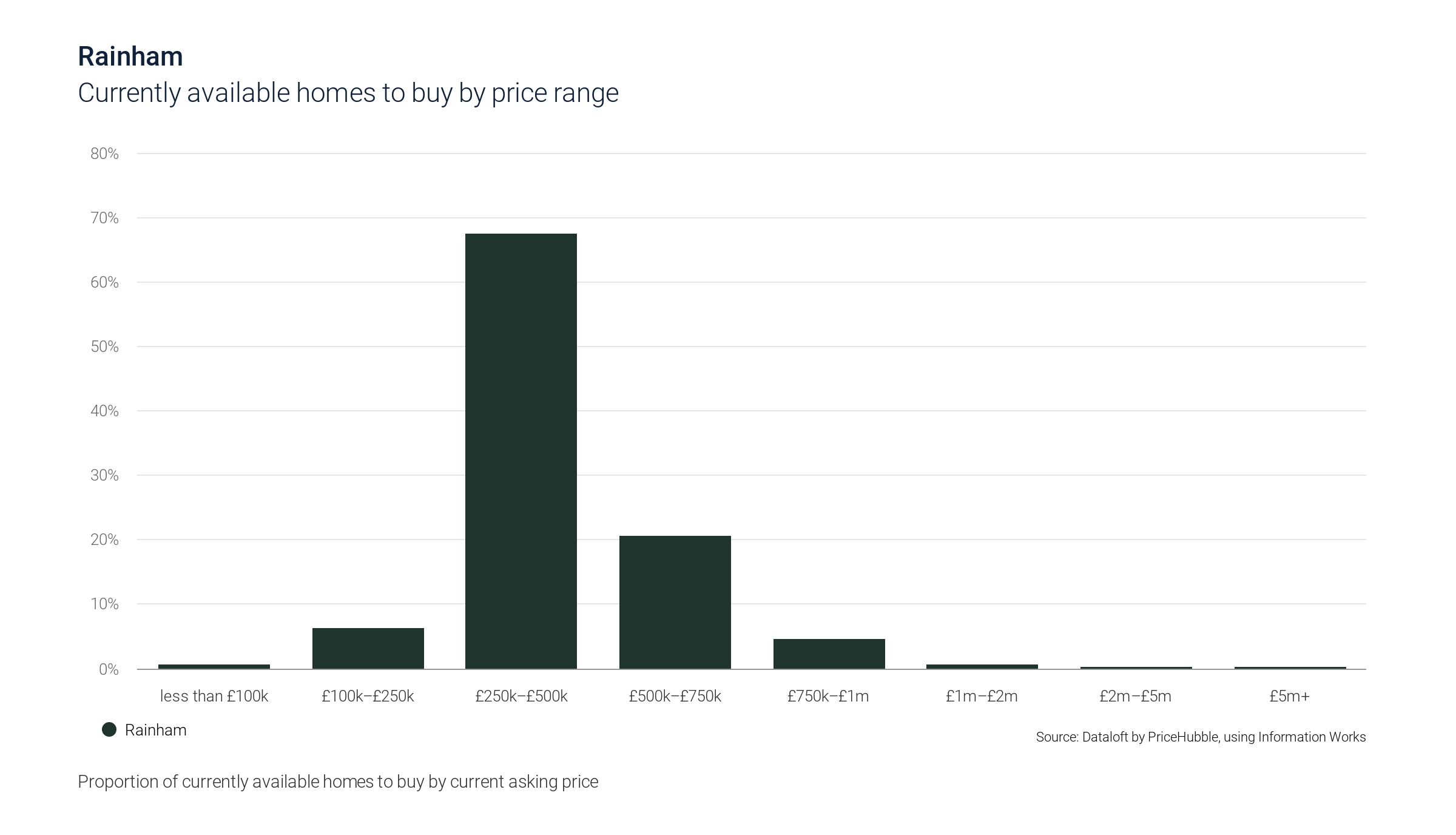

The property portfolio is strategically concentrated in the mid-market sweet spot, with 67.43% of stock valued between £250k-£500k. This core market focus, complemented by a balanced mix of premium properties (20.57% at £500k-£750k) and entry-level options (6.29% at £100k-£250k), creates a resilient investment environment. The limited high-end inventory (4.57% above £750k) suggests potential for value growth in premium segments.

[Source: Local Market Data, 2024]

Why Rainham?

Rainham has emerged as a strategically positioned investment hotspot in 2024, with market dynamics that demand attention. Dataloft reports showcase remarkable market efficiency, with properties moving 4.9% faster than the previous year – averaging just 26 days on the market. This pace reflects both demand intensity and realistic pricing strategies.

Key market indicators demonstrate particular strength:

- A robust 21% of renters aged 25-29, driving consistent rental demand

- Strategic price advantage compared to neighbouring London boroughs

- Significant infrastructure investments enhancing long-term growth prospects

Market analysis reveals an often-overlooked opportunity in the flat sector, currently at just 4.6% of transactions despite growing demand. This, combined with efficient property turnover rates and strong rental yields, positions Rainham uniquely for both immediate returns and sustained growth. The area's continued infrastructure enhancement and attractive price points relative to London make it an increasingly compelling proposition for investors and homeowners alike.

[Source: Dataloft]

Looking Ahead to 2025

Rainham stands at an exciting crossroads as we approach 2025, blending established market strength with emerging opportunities. The area's carefully balanced population density of 26.6 people per hectare tells a compelling story – one of sustainable growth potential while preserving the community charm that makes Rainham distinct.

As market specialists deeply embedded in the local property market, we see Rainham's value proposition strengthening further. The combination of strategic connectivity, ongoing infrastructure enhancements, and robust market fundamentals creates an increasingly attractive proposition for both homeowners and investors. Whether you're exploring rental opportunities or seeking long-term investment, Rainham's trajectory suggests sustained growth and stability.

Our comprehensive Rainham area guide can help you navigate this buzzing market with confidence, leveraging decades of local expertise to unlock Rainham's full potential. As we look toward 2025, Rainham's story is one of measured growth, strategic opportunity, and enduring value.

Why not contact our local estate agents in Rainham?

Other Stories

21 April 2025

Your April 2025 Property Market Update

17 April 2025