Welcome to the January 2025 edition of the Property Market Update by Quealy & Co! We have gathered insights from UK experts to provide a comprehensive overview of how the market concluded in 2024. We also give insights into what’s in store for the property market 2025.

December 2024 was a month of positive growth for the property market, as indicated by the most significant indices showing a year-end growth.

Nationwide reports a positive trend in the UK property market, with house prices closing out 2024 up +4.7% compared to December 2023. This modest yet consistent growth, with a month-on-month increase of +0.7% after seasonal adjustments, sets a promising tone for 2025.

Halifax's data tells a slightly different story. Their average house price settled at £297,166, showing a minor monthly decline of -0.2% but maintaining healthy annual growth of +3.3%.

A strong end to 2024

Despite the economic challenges, the sales market demonstrated remarkable resilience throughout December. Zoopla reported the largest pipeline of sales progressing to completion in four years, a testament to the market's stability and potential for growth.

As we enter 2025, 283,000 sales worth £104 billion are moving through the system, representing a substantial +30% increase compared to last year.

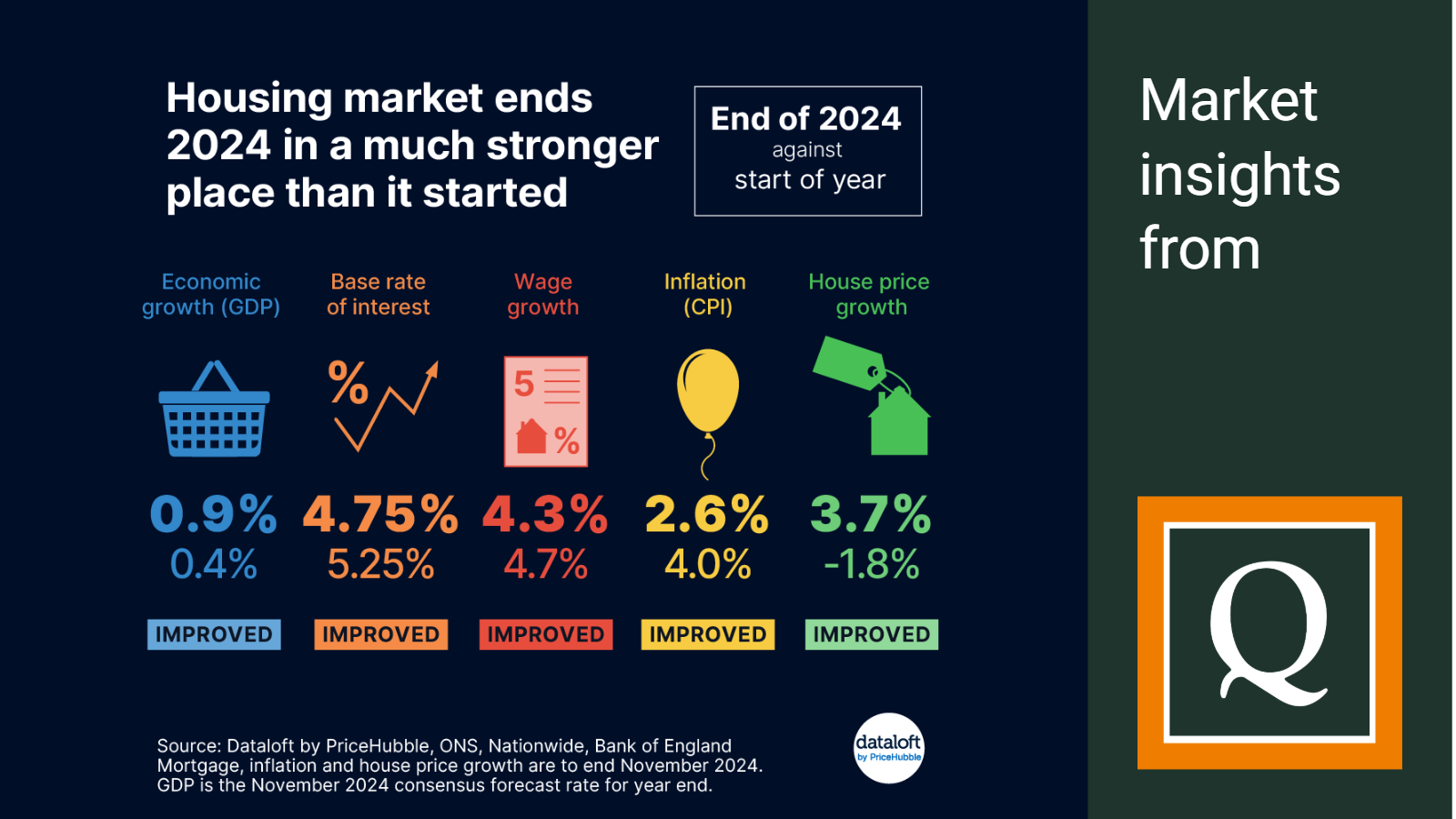

At the start of 2024, interest rate cuts had yet to commence, inflation was double the target rate, and economic growth wasn't strong enough to help drive house price growth.

By the end of 2024, a range of those economic drivers had improved, and contrary to pessimistic consensus forecasts at the start of the year, house prices had grown by 3.7%.

Lower inflation has been critical to that change, allowing the Bank of England to start cutting interest rates. Five-year mortgage rates are improved compared to this time last year and significantly improved compared to two years ago.

Economic growth has been sluggish, and there have been points throughout the year that caused growth to pause (uncertainty surrounding the General Election in July and the Budget in October). Still, nevertheless, economic growth has been more substantial in 2024.

Regional variations continued to shape the market landscape in December, with northern regions outperforming their southern counterparts. Northern Ireland maintained its position as the best-performing area for the second consecutive year, whilst East Anglia experienced more challenging conditions.

Buyer activity

December's buyer activity was particularly promising, with Rightmove reporting a 13% increase in new buyer demand, and RICS data showing a net reading of +12% for new buyer enquiries.

However, buyers displayed increased price sensitivity, particularly following the recent budget, with many securing properties below the asking price in the fourth quarter of 2024.

Seller confidence and asking prices

December saw continued growth in seller activity, with new instructions rising to +17% from +14%, according to the Royal Institute of Chartered Surveyors (RICS).

However, Rightmove notes that new seller asking prices dropped by a seasonal 1.7% (-£6,395) to £360,197, though prices still ended the year +1.4% above December 2023. Interestingly, first-time buyer homes in the North East bucked this trend, showing a 1% increase in December.

Looking ahead to 2025

2025 looks set to be a similar year for the housing market: economic forecasts currently suggest a little potential upside to GDP growth, continued lower inflation (although sitting just above target) and further interest rate cuts.

The outlook for the new year seems cautiously optimistic, though challenges may arise. Rightmove forecasts a +4% rise in new seller asking prices over 2025, whilst Zoopla predicts a continued recovery in sales volumes, reaching 1.15m with modest house price inflation of 2.5%.

However, upcoming Stamp Duty changes could create market volatility, particularly in the first quarter of 2025. Robert Gardner, Chief Economist at Nationwide, suggests we might see a transaction surge before the changes take effect, followed by a potential slowdown.

Summary

December's figures offer an encouraging conclusion to 2024, with the property market demonstrating remarkable resilience despite the challenging economic backdrop.

Despite ongoing regional disparities and price-conscious buyers, the robust sales pipeline and rising buyer demand are positive signs as we enter 2025, indicating a solid foundation for the year ahead.

Moving Home in Kent?

Quealy & Co. brings you all the latest property market news each month. For a more localised property report for your specific postcode, please get in touch with the team on 01795 429836 or email hello@quealy.co.uk. We’d be happy to send you one for free.

You can also use our instant online valuation tool if you want a ballpark figure of your home's value to sell or to let: Click here.

Note: The information in this article is based on data as of January 2024 and may change. Always seek professional advice for your specific circumstances.

Other Stories

28 March 2025

Design An Easter Egg Competition!

17 March 2025

Your March 2025 Property Market Update

09 March 2025

by

by