October and November brought an array of new developments across the UK property market. Interest rates have been cut, mortgage rates continue to adjust and the number of homes on the market is at the highest level since 2014. The Autumn Budget brought had several elements that homeowners, homebuyers and landlords should take into account.

Interest Rates Cut, Mortgage Approvals Rise

Last week, The Bank of England cut interest rates for the second time this year as expected. It has set the rate at 4.75%, down from 5%. The decision means rates are now at their lowest point in more than a year. The last time rates were below 5% was June 2023.

Of all the factors persuading home-buying decisions, economic prospects and interest rates have a substantial influence. The boost in buyer confidence could mean a busier property market than expected as we head towards the end of the year.

Autumn Budget 2024

Key Points:

- Stamp duty increased to 5% on additional homes

- Higher stamp duty thresholds remain in place for first-time buyers and movers until April 2025, but are then set to be lowered

- Capital Gains Tax increased but rates on residential property sales to remain at 18% and 24%

- £500 million pledged for affordable housing

For more detailed information on the Autuman Budget, read our article:

Autumn Budget: Valuable Insights For Homeowners And Landlords

Sellers: Make Your Property Stand Out

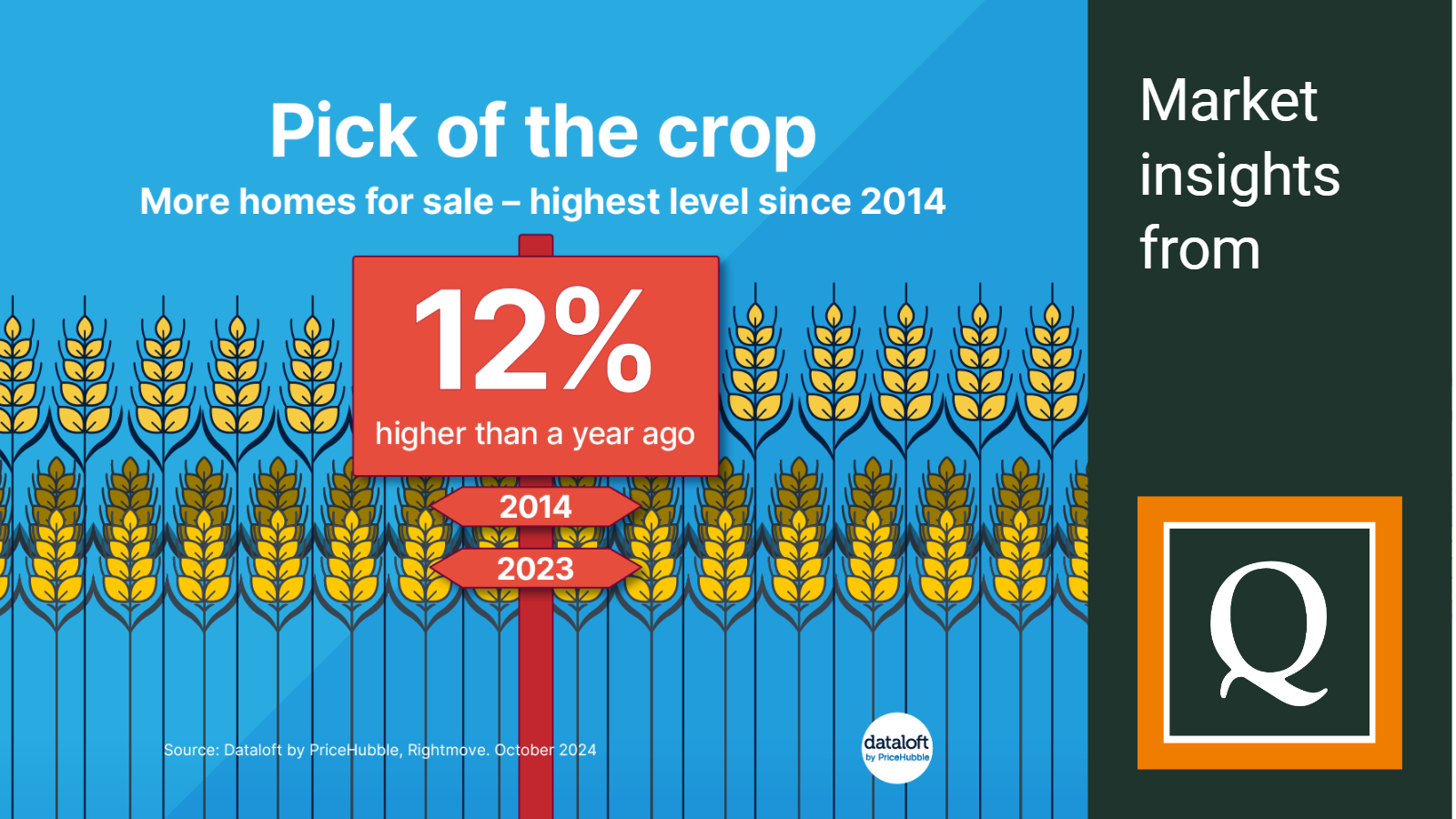

The number of available homes for sale per estate agent has reached its highest level since 2014 and 12% higher year-on-year, giving buyers the pick of the crop. Despite strong housing market activity, the number of new properties hitting the market and the time they take to sell are both rising, leading to an increase in available homes for sale.

In this buyers market, sellers must price competitively to achieve a sale as affordability remains stretched and choice levels are high.

With more properties entering the market, sellers need to ensure their homes capture buyers’ attention. According to data from the Land Registry, homes priced up to £350,000 are selling the fastest as buyers prioritise affordability. Sellers should think creatively about how to make their property more appealing.

Tips for Selling your home in Kent:

- Highlight Energy Efficiency: With increasing energy costs, energy efficient features are a strong selling point. Simple upgrades, such as adding draft-proofing or energy-saving bulbs, can boost appeal.

- Focus on Online Marketing: Make sure your estate agent is promoting your property online, including on social media. At Quealy & Co, we are highly proactive on our socials, ensuring your home gets the best online coverage.

- Be Transparent About the Property’s History: Buyers appreciate upfront information, so sharing recent upgrades or repair work helps build confidence.

Why not add a touch of seasonal magic to your home for viewings. Tasteful autumnal wreaths or pumpkins by the door can go a long way to making your home look cosy and appealing.

It’s a Buyer’s Market

For homebuyers, there are reasons for positivity. While affordability continues to be a concern, mortgage rates have somewhat improved, giving prospective buyers a chance to secure better deals. Nationwide reports that the average UK house price is currently around £262,000, so this could be a good time to step into the market if you’re prepared.

Tips for Buyers:

- Consider Homes with Potential: With more properties in Kent coming to the market, exploring those in need of minor updates could be a savvy move. You may find a home at a lower price that you can add your own personal touch to.

- Take Advantage of First-Time Buyer Schemes: Schemes like the Lifetime ISA or Shared Ownership are still widely available.

- Look for Keen Sellers: As the year draws to a close, some sellers may be motivated to secure a deal, so a little bit of negotiation could go a long way.

View our current properties for sale in Kent to find your ideal home.

Property Market Outlook

This month, the UK property market brings a mix of opportunity and challenge. Buyers can find some excellent deals and sellers need to go the extra mile to make their property stand out.

Whether you’re buying or selling a property in Kent, the team at Quealy & Co are here to help you.

Call us on 01795 429836 or email hello@quealy.co.uk to chat with a member of our friendly and experienced team.

You can also use our instant online valuation tool if you want a ballpark figure of your home's value to sell or to let: Click here

Other Stories

18 November 2024

Quealy & Co Christmas Opening Hours 2024

09 November 2024

The Most Popular Christmas Decor Trends This Year

01 November 2024

by

by